Is it still time to overweight listed real estate?

Is it still time to overweight listed real estate?

Public outperformed private real estate last year and is expected to continue

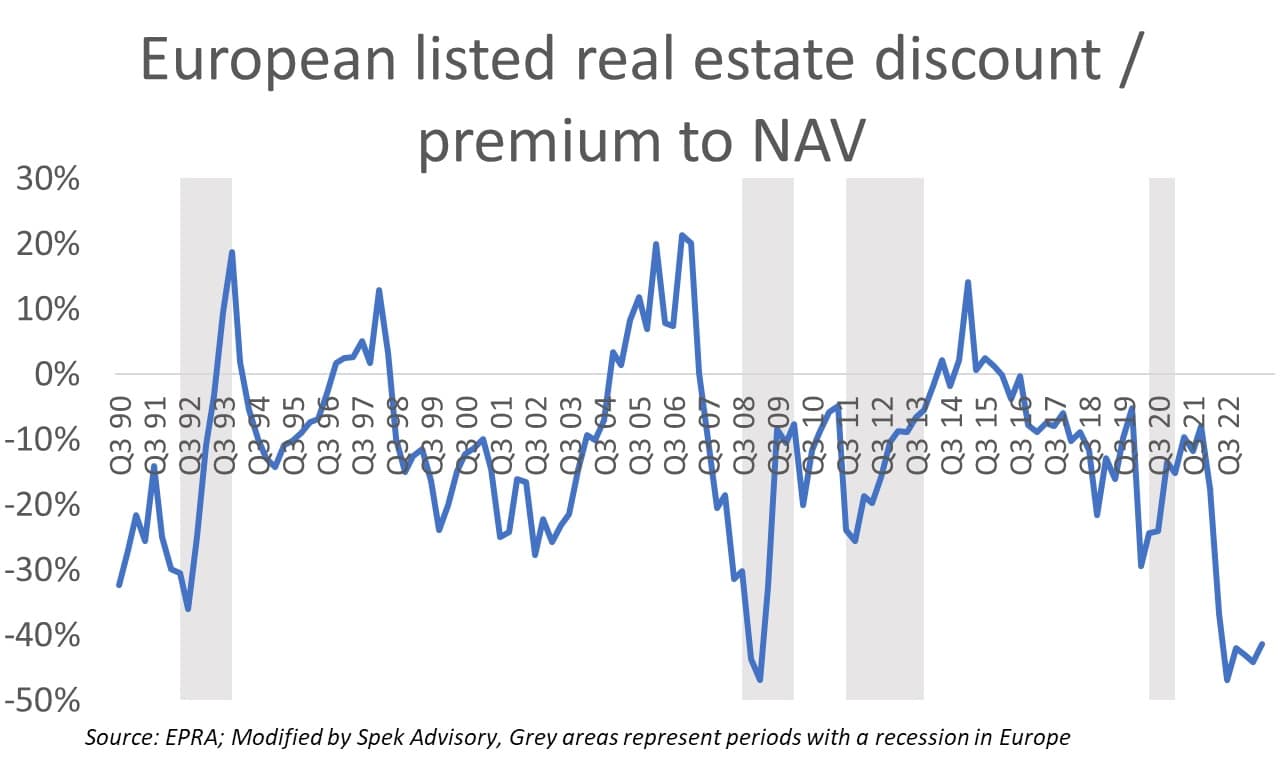

Last year, we published a blog detailing the relationship between public and private real estate through the discount to NAV (Net Asset Value) metric. This metric emerged as a reliable indicator of relative performance. A higher discount suggests that public real estate may outperform private real estate in the coming five years.

We projected an expected outperformance of approximately 7.5% annually over this period. The chart below offers an updated analysis, distinctly illustrating the inverse relationship between premium levels and future relative performance.

To read the full blog and/or receive any of the previous blogs in full, please subscribe to our (always free) bi-weekly blog and send us a quick message including which past blog(s) you would like to read.