Long-term investors should avoid asymmetric risks

Long-term investors should avoid asymmetric risks

Investment opportunities in digital real estate are limited and still in early days

Did you invest in Russia, hoping to reap high returns? If you exited on time, you may have been fortunate. However, many investors faced disappointing returns, limited liquidity, and, due to Russia’s aggressive territorial expansion, now have little hope of recovering their capital.

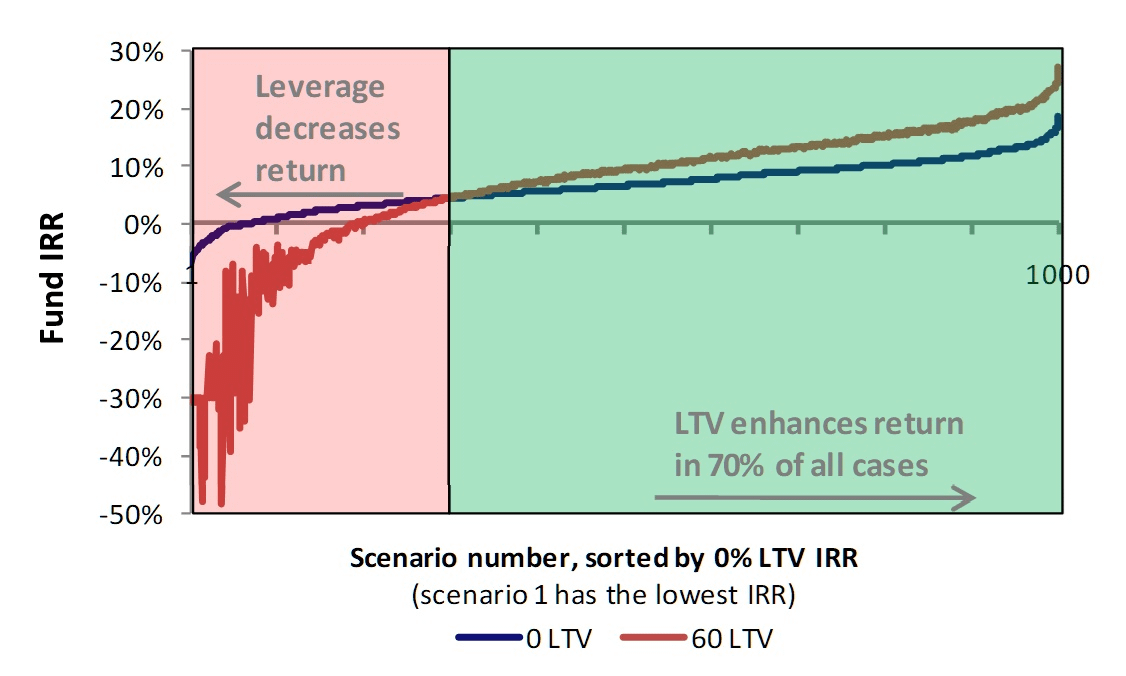

Asymmetric risks play a crucial role for long-term investors. These risks, by nature, offer limited upside but carry a substantial downside. The greater the asymmetry, the higher the risk. A key example is leverage, often discussed for its potentially severe consequences. Figure 1 demonstrates this by showing 1,000 simulated IRR outcomes in a 0% and 60% leveraged real estate fund, ordered by unlevered IRR. As leverage increases, so does the risk of significant loss, even if there’s potential for marginal gains. Limiting leverage will subdue the asymmetric impact.

Figure 1: All 1000 simulation IRR outcomes using a 0% and 60% levered real estate fund ordered by unlevered result. Limited upside is diminished by substantial downside.

There are a number of risks that are asymmetric, or can become substantially asymmetric during certain periods. Without trying to be complete, the following risks can be viewed asymmetric:

-

- Leverage Leverage can lead to disastrous outcomes, as evidenced during the Global Financial Crisis (GFC). Academic studies suggest that long-term investors should limit leverage to 20-30% to maintain a favorable risk-return profile.

- Geopolitical risk Investing in regions with high geopolitical risk—like Russia or Argentina—can be lucrative in stable times but catastrophic during turmoil. Liquidity can vanish, and assets can be lost due to corruption or regulatory, and geopolitical factors. Given the current tensions, even countries like China or Israel pose increased risks. It begs the question: is the reward worth the risk?

- Development Development represents another asymmetric risk, also known as operational leverage. The early ’90s development boom turned disastrous when the market oversupplied real estate during an economic downturn, leading to widespread bankruptcies among developers. Development can be highly profitable during good times but disastrous in downturns.

One could say that sectors could also present asymmetric risks, as shown with retail since 2016 or US office now. This however is driven by an external effect that changed the risk return profile of retail structurally (like e-commerce in retail and working from home in US offices).

Managing asymmetric risks

Since Russia’s military actions in Ukraine, geopolitical risks have become more acute, leading some to suggest that Western investors should limit their exposure to China amid escalating tensions. When making such decisions, it’s crucial to consider market liquidity, how these investments contribute to the portfolio, and potential alternative exposures.

While asymmetric risks can offer short-term gains, they come with significant downside risks. Investors and investment managers often seek these risks because they can boost returns in stable years. However, long-term investors should be cautious about heavy exposure to these high-risk factors, as they can lead to substantial losses during periods of turmoil. By carefully weighing these risks, investors can reduce the impact of economic of systemic shocks, thereby enhancing the likelihood of long-term success.